The Sterling Opportunity Fund 1 LLC acquires, develops and manages assets primarily located in the Opportunity Zones which exist in major cities throughout the country.

The advantages of acquiring, developing and holding assets in the opportunity zone are three-fold.

- Opportunity Zones are designated as growth opportunities in underserved communities and have greater upsides of the development potential.

- Opportunity Zone investment presents a capital gains tax deferment until 2027.

- Opportunity Zone investment allows for a long-term capital gain tax exclusion when assets are held for a ten-year period.

What is a Qualified Opportunity Zone?

A Qualified Opportunity Zone (QOZ) is a designation created by the Tax Cuts and Jobs Act of 2017 to encourage investment in economically distressed communities. The program allows investors to defer and potentially reduce capital gains taxes by investing in Qualified Opportunity Funds (QOFs), which are investment vehicles that deploy capital into businesses or real estate projects located in designated Opportunity Zones.

Potential Benefits of Opportunity Zone Investing

Defer taxes on earned capital gains

Avoid paying federal taxes on your capital gains

What this may mean for you?

If you are facing a significant tax liability as a result of capital gains, investing in a Qualified Opportunity Fund may be worth exploring, provided you invest within a prescribed amount of time.

Eligible Gain Types

1. Sale of Stock

2. Sale of Real Estate

3. Sale of Business

Tax Benefits of Investing in Opportunity Zones

- Depreciation Deductions

- Significant depreciation deductions over the life of the project

- Deductions generally equal 100% or more of investor cash investment within 5 years of the building being placed in service

- Deductions generally around 3X an investor cash investment over the depreciable life of the building (30 years)

- Depreciation Recapture

- Depreciation Losses

How does this program work?

To defer a capital gain (including net §1231 gains), a taxpayer has 180 days from the date of the sale or exchange of appreciated property to invest the realized capital gain dollars into a Qualified Opportunity Fund, an investment vehicle that files either a partnership or corporate federal income tax return and is organized for the purpose of investing in Qualified Opportunity. The fund then invests in Qualified Opportunity Zone property.

Disclosures & Risks

An investment in Sterling Opportunity Fund 1 LLC (the “Fund”) will involve a high degree of risk and is suitable only for investors that have no immediate need for liquidity of the amount invested and can withstand a loss of their entire investment in the Fund. When analyzing an investment in the Fund, prospective investors should consider, without limitation, the following risks, and should also carefully review the more thorough discussion of risk factors and potential conflicts of interest contained within the Fund Documents (defined below).

Zahrada plná barev a života s pnoucími rostlinami

Zahrada je místem, kde se spojuje krása přírody s lidskou kreativitou. Je to místo, kde můžeme projevit svůj vkus a zároveň si užívat klidu a

Exploring the Delightful World of Fusion Cuisine: A Journey Through Taste

With the world becoming more globalized, the line separating traditional cuisines from different cultures is increasingly blurred. This has led to the rise of fusion

Ein- und Auszahlungen bei Dreamplay: Was österreichische Spieler wissen sollten

In diesem Artikel werden wir die verschiedenen Möglichkeiten für Ein- und Auszahlungen bei Dreamplay untersuchen. Österreichische Spieler sollten sich über die verfügbaren Zahlungsmethoden, die Sicherheit

Krok po kroku: jak przebiega proces rejestracji w serwisie Naobet

W dzisiejszym artykule przyjrzymy się procesowi rejestracji w serwisie Naobet, który staje się coraz bardziej popularny wśród graczy w Polsce. Jeśli zastanawiasz się, jak zacząć

Guida ai metodi di pagamento su Smokace Casino per italiani

Se sei un appassionato di giochi online e stai esplorando il mondo di smokace casino, probabilmente ti starai chiedendo quali metodi di pagamento siano disponibili

Hoe activeer je Voltslot free spins bij registratie?

Hoe activeer je Voltslot free spins bij registratie? Table of Contents Wat zijn Voltslot free spins? De voordelen van free spins bij Voltslot Stappen om

Managing Partners

Terry Johnson

Managing Partner

Mr. Johnson Has over 23 years of experience in real estate development with a strong background in construction management. He has both a Bachelors of Arts and a Master’s degree in Business Administration. Currently the Managing Partner of the Sterling Opportunity Fund 1 LLC.

Michael Graham

Managing Partner

Mr. Graham has over 30 years in real estate development, management and design. He graduated San Diego State University with a BS in Civil Engineering and received his MBA from San Diego State University. Currently the Managing Partner of the Sterling Opportunity Fund 1 LLC.

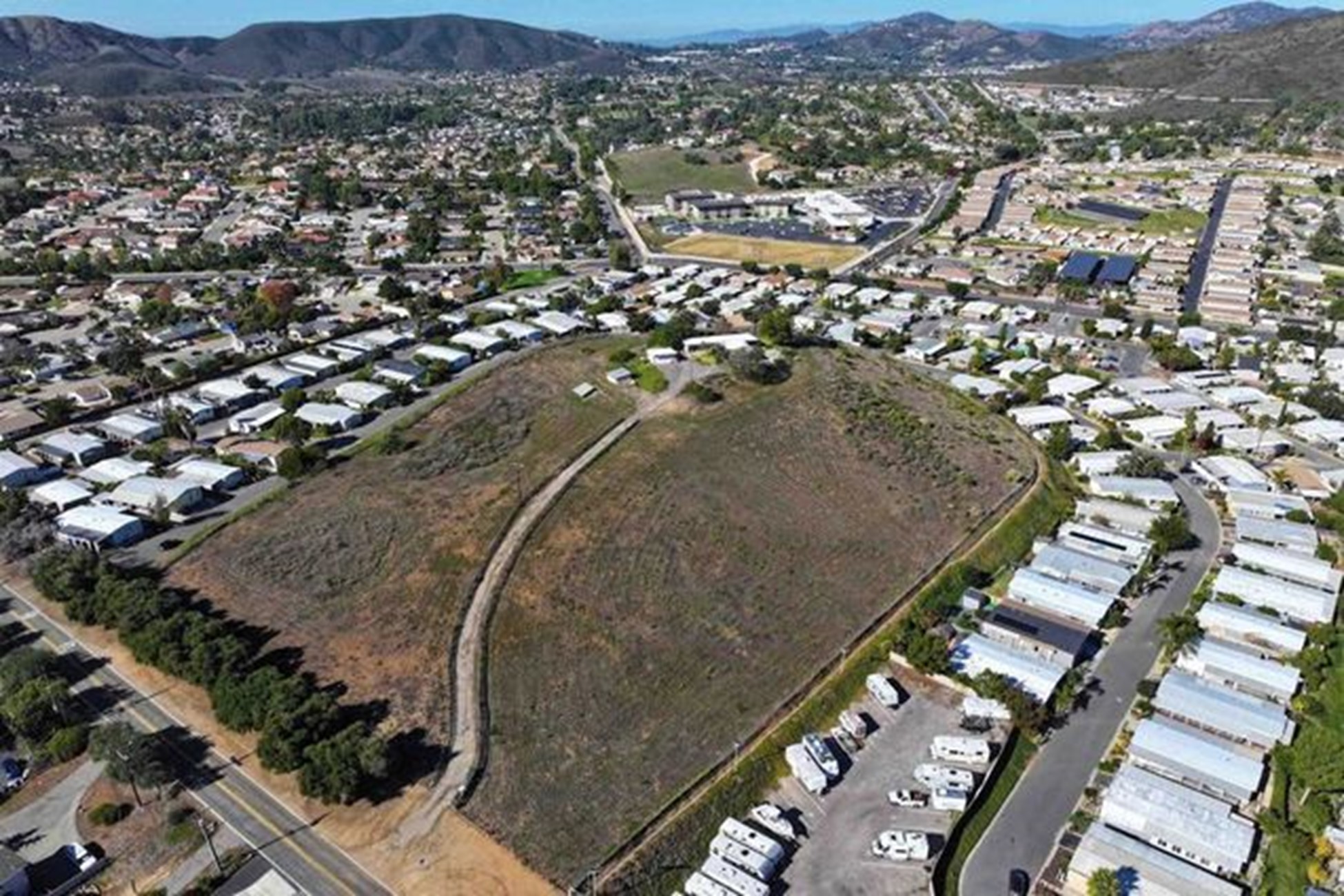

- Opportunity Zone Fund 1

- 2205 Corte Del Nogal Carlsbad CA 92011

- Phone : 858 633 7167

- Email : info@sterlingof1.com